Every retailer plans ahead, but most limit themselves to looking forward just one season when they are out buying. When you have eight department stores totalling 384,000sq ft to look after, the planning needs to be somewhat longer in scope, which is why David Hordle has plans for refurbishment work from 2019 until 2021 on his desk.

The beneficiaries of the extensive seven-figure programme will be Morleys in Brixton, South London and Pearsons in Enfield, North London. David, managing director of the Morleys Group since August 2014, plans physical improvements, alterations and a ground-floor extension in Enfield. The upgrades will also see a reshuffling of the brands each store offers, and how and where they are presented.

Building success through environment, brands, and people

David’s formula for a modern department store is environment + brands + people = success. The dividends of that approach are best seen in the flagship, Elys of Wimbledon, which is also the base for the group head office. Over the past five years Elys has had more than £5m of capital expenditure spent on it.

All four floors have been extensively refurbished, with new flooring, lighting and fixturing the norm, giving Elys an immaculate contemporary look, as our photos show. Some 2,500sq ft of selling space was “created” on the ground floor by opening up most of the traditional display windows and relocating the footwear department (and its extensive stock rooms) from the ground to the first floor.

In another key development, the store’s main restaurant and bar on the third floor was totally redesigned. On the second floor, which is given over to home and kidswear, an impressive 2,500sq ft concession area for The White Company represents a coup for Elys that has benefited the group.

“To partner with The White Company really indicates where we want to take Elys,” David explains. “It took about 12 months to seal the deal but after they opened here in summer 2016 they were happy to open with us in Camp Hopson, our store in Newbury. On the cosmetics floor, bringing in Jo Malone was another statement of intent that says a lot about us. More recently, in the accessories department, it’s been Michael Kors.”

The work at Elys is not quite finished. By Easter a new 3,000 sq ft Urban Beauty department will be opened adjacent to the store, linked to the cosmetics floor via an arch. In a former Rymans unit, it will house MAC Cosmetics, Londora Nail Boutique and Eye Candy Lash Boutique at ground level with additional beauty services on a mezzanine.

“Things like this, and our personal styling service on the fashion floor, our on-site alterations service, plus our restaurant-bar, are all part of the experiences that a department store must offer. Customers can’t get these things online, which is one of the reasons we must remain attractive and relevant,” says David.

While the well-publicized struggles of Debenhams and House of Fraser have some people erroneously predicting the death of the department store, they overlook the fact that those businesses have been badly run by various managements over the years.

The Morleys Group benefits from having been owned by the same family for more than 90 years. The chairman and sole shareholder, Bernard Dreesmann, has worked in the business for around 40 years. It was in 1927 that his grandfather bought the first part of the group, the Morley and Lanceley store in Brixton (now called Morleys). The modern era for the group began in 1996 when Bernard, having succeeded his father as chairman, bought Elys of Wimbledon. Half of the group has been acquired or opened since the 1990s.

Expanding and modernizing the Morleys Group

The Dreesmann family’s approach is usually built around acquiring the freehold when they buy a business. Only the most recent store, Morleys of Bexleyheath, Kent, opened in 2017 in a former BHS property, is leasehold, albeit on a 90-year lease.

“Bexleyheath was a new experience for us because it was essentially a new store,” David explains. “It’s brought its own challenges to create awareness, but we are getting there.”

Things went slightly easier at Camp Hop-son in Newbury, Berkshire, which Morleys bought from the Hopson family in 2014. In the past three years the acquisition, which has two buildings, has benefited from investment of £2.7m. The business has been simplified, with its former furniture store now selling, logically enough, furniture, furnishings and linens, while the main building concentrates on fashion and beauty. New brands like Jo Malone, Bobbi Brown, Polo Ralph Lauren and Ted Baker, plus sharper merchandising, saw sales in the main store grow by over 20% in the first year following redevelopment.

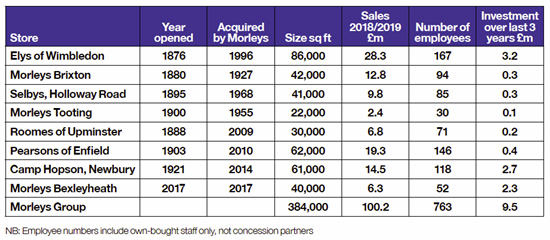

As shown in the table opposite, apart from Bexleyheath, each of the stores in the group has been trading for between 98 and 143 years and they mean something in their respective communities. It is to the Dreesmanns’ credit that they have never thought of rebranding them with one name.

Centralising all buying, finance and HR teams, however, has been completed in the past two years. The closure of Bodgers of Ilford, which was the group’s discount outlet and had a small accounts department, permitted all group functions to be centralised at Wimbledon.

“We closed Bodgers in February 2018 and, before my time, Pearsons in Bishop’s Stortford in 2012 because they did not justify having further money spent on them. Tough decisions but they made sense for the group as a whole,” says David.

As part of the efficiency programme David has overseen in his four years as MD, a new integrated Epos system now gives a real-time view of stockholding. An ex-BHS merchandise controller was hired to improve stock allocation across the eight sites. David now wishes he had a centralised warehousing facility.

Having spent 23 years with Marks & Spencer and four years with Boots, David has brought big-company experience and disciplines to Morleys. The management team is streamlined, with Bernard Dreesmann as chairman, David as MD, a financial director, two buying directors (one for fashion & beauty, the other for home), a joint HR & retail operations director, and ahead of marketing, who is the most recent addition having been appointed in the past year.

“One team all pulling in the same direction can achieve so much,” says David. “We have a brilliant group of 12 buyers, who are split about 60:40 across fashion & beauty and home, our two main divisions. About two-thirds of what we sell across the group is own-buy, with the balance as concessions. If anything, we will slightly increase own-buy over the next few seasons because we are confident about what we want to sell, it gives us more control and a better return on our investment.”

Pointing out the premium outerwear labels Belstaff and Woolrich in the menswear department of Elys, he reveals that menswear has been one of the outstanding-performing categories in the store: “We give our buyers the freedom to bring in new things, even if it’s just in a small way. Our job is to stay just about half a step ahead of our customers. We need to lead them, yes, but not get too far ahead of them.”

Investing in staff and understanding customers

After environment and brands, the third element in David’s retailing mantra, people, are also invested in. Two years ago he hired a former Boots colleague to lead a new learning and development programme for the Morleys group. Although the recently-introduced Apprenticeship Levy has many critics, David is a fan and Morleys is an enthusiastic user of its funds: “We are paying over £50,000 a year into the levy but we are getting all that back and more to assist in training and developing our future stars.”

Drawing on his own experiences at M&S and Boots and those of his HR and retail director, Morleys has introduced individual development plans for its 760-plus staff, and a formal retail apprenticeship programme is running, with 20 staff involved and 12 more lined up to join this year. The central hub of the various training initiatives is styled "The Morleys Academy".

At a higher level, for the past four years the business has sent two candidates to the Foundation course or the Academy course at OSS Retail (formerly the Oxford Summer School), on whose advisory board David serves.

In an inspiring move that indicates how important staff development is, Morleys is one of the first employers to offer a Retail Leader Apprenticeship Degree via Retail Right, the training arm of Retail Trust.

“Like many larger retailers, we do have issues in retaining shopfloor and administration staff, 60% of whom are paid just above the living wage. Staff turnover in Upminster and Tooting is in the low teens, but it can go up as high as 25% in Wimbledon and Enfield. With our efforts on learning and development, we want to show our core colleagues that they can build a career with us.”

Another important strand of work in recent years has been to improve the group’s knowledge of its customers. Five of the eight stores now offer a loyalty card which earns 3 points for every pound spent in the beauty department and 1 point for every pound spent elsewhere in the store. Two years ago Elys was the pilot for the scheme and it has been a fascinating, enlightening and valuable lesson.

“The Boots Advantage card, which I know a lot about having worked there, is one of the best loyalty cards in retail. All retailers claim to know their customers, but they are usually meaning a gut instinct rather than hard facts,” David argues. “In two years we have added over 40,000 names to the Elys scheme and we now know a lot more about them than we did previously. It was a surprise, for example, to discover that 50% of the sales in Wimbledon are made by customers whose addresses are within a mile of the store. In terms of the insight this sort of analysis can give us, I’d have to say we are just scratching the surface.”

One area that remains untouched by the group is selling online. E-commerce consultants have been engaged to draw up a feasibility study, but investing in bricks-and-mortar, constant store improvements and staff development all take priority: “We have discussed going trans-actional a lot, but our chairman rightly keeps asking about the danger of diluting profits while not actually achieving any incremental sales. For us to enter ecommerce would be like setting up an entirely separate business and we see more benefit in acquiring existing stores.”

Bernard Dreesmann’s desire to add to his portfolio is well known in independent department stores circles, but there are very few that meet his criteria of being in reasonable financial shape and coming with a freehold. No Morleys store is more than 65 miles from the Wimbledon head office, so geographical location is another consideration.

With eight stores to look after the Morleys team has plenty to keep them busy, especially in what David carefully refers to as “these more modest trading conditions”. Proving, perhaps, that investment brings its own reward, Elys and Camp Hopson both traded ahead on sales last year, while the rest of the group saw a flat performance. Thanks to the new efficiencies in buying and merchandising, gross margin improved.

Looking forward in these uncertain times, David is keeping his expectations realistic: “I cannot see any reason that trading conditions will improve in the near future, so managing to be like-for-like will be ahead of the curve.”

With its grasp of classic retailing values and an owner who invests in stores, Morleys is well set to stay a step ahead of its rivals.

Your stories matter the most...

We take great pride in sharing successes, developments and updates from our members.

Read our member stories here.

Latest Resources

-

Valentine's Window Display Competition

Win a membership subscription voucher by getting involved with Bira's Valentine's Window Display Competition!

-

Taking the next step with planograms: A practical step-by-step guide to remerchandising your shop

A practical guide to using planograms at shelf, category and store level to plan remerchandising more clearly and effectively.

Date Created: 03/04/20219

Date Updated: 12/12/2024